Explore Mode 4684 and its instructions to find your own allowable casualty and theft losings. Yet not, there is certainly a different rule, explained next, for sure nonresident aliens of India. You might allege write-offs to find your own effortlessly connected taxable earnings (ECTI). You generally never allege deductions regarding income that isn’t related to your own You.S. team items. Apart from specific itemized write-offs, talked about afterwards, you could potentially claim deductions simply to the fresh the amount he or she is linked with your effectively linked income.

Pearl lagoon casino uk | What is the interest rate if i discover an excellent U.S. Lender Intelligently Family savings?

To learn more about this exception, discover Setting 4563 and you may Pub. When you are a shareholder in the a shared finance (or other RIC) otherwise REIT, you could potentially claim a cards for your show of every fees repaid by the organization to your its undistributed enough time-name funding gains. You’ll receive information regarding Form 2439, you must affix to their return. For many who didn’t have an SSN (or ITIN) awarded to your otherwise through to the deadline of your own 2024 go back (along with extensions), you will possibly not claim the little one tax borrowing on the possibly the new otherwise a revised tax go back. If you are notice-operating, you’re capable subtract contributions to a sep, Effortless, otherwise accredited later years plan that provide pensions for your self and you may their common-laws personnel, if any. And make allowable contributions for yourself, you really must have online income from mind-a job that will be effortlessly associated with their U.S. trade or team.

So it provision can be applied just to you to portion of the believe you to is actually owing to benefits in order to corpus generated immediately after February step one, 1984. Do not file a duplicate of your own decedent’s often or the believe tool except if the new FTB needs one. If the fiduciary really wants to expand or change the repaid preparer’s authorization, visit ftb.ca.gov/poa. In addition to Mode 541, the fresh fiduciary have to document an alternative Schedule K-step 1 (541) or an FTB‑recognized solution to per beneficiary. Controlled Financing Organizations (RIC) and Investment Trusts (REIT).

The newest Threat Against A property Investors Today and just why Tenants Is to Be Handled while the Clients

- All of Ted’s income while in the Ted’s stand we have found U.S. source earnings.

- Should your Atm doesn’t wanted an envelope, heap the bills and you will/or monitors together and you will submit her or him.

- Our very own term put rate of interest analysis will be based upon items analysed from the Funds from banking companies included in the federal government’s Economic Says Strategy.

- If you were a good U.S. citizen while in the any an element of the preceding calendar year therefore is a great U.S. citizen the area of the latest 12 months, you happen to be sensed a good You.S. citizen at the beginning of the modern 12 months.

- Go into the full taxation from Form 540, range 65, for the Mode 541, range 28, and you will complete the rest of Mode 541.

But, in the event the a citizen owes back rent or charges, the house director often will deduct you to count in the unique deposit. The fresh property manager will also costs tidy up charge on top of the reviewed ruin will set you back. Forty-one percent out of respondents said it anticipate to receive 100 percent of their protection put came back, and you may an extra 31.8 percent say they be prepared to have more than 1 / 2 of it straight back. Undoubtedly, citizen degree regarding the protection dumps is required, and taking higher openness to your state is actually warranted. Inside the Baltimore, Gran Brandon Scott vetoed a “Renter’s Alternatives” laws that had introduced the city council several-to-dos, once a period-enough time outcry away from a long list of neighborhood communities. “I simply don’t overlook the extreme issues across the security put insurance solution from the laws and regulations,” Scott said inside the an announcement following the veto, the first away from his term.

Income tax Go back for Settlement Money (less than Section 468B), and you may people comments otherwise elections necessary for Treasury Legislation in order to create 541. The brand new instructions provided by Ca taxation forms is actually a summary of Ca taxation laws and they are only intended to support taxpayers inside the making preparations hawaii tax productivity. I is guidance that is better to your better amount out of taxpayers regarding the limited space available. That isn’t it is possible to to provide the criteria of your Ca Cash and you may Taxation Password (R&TC) on the guidelines. Taxpayers shouldn’t look at the tips while the authoritative law. M&T Financial is offering another account promotion one to’s very easy to score.

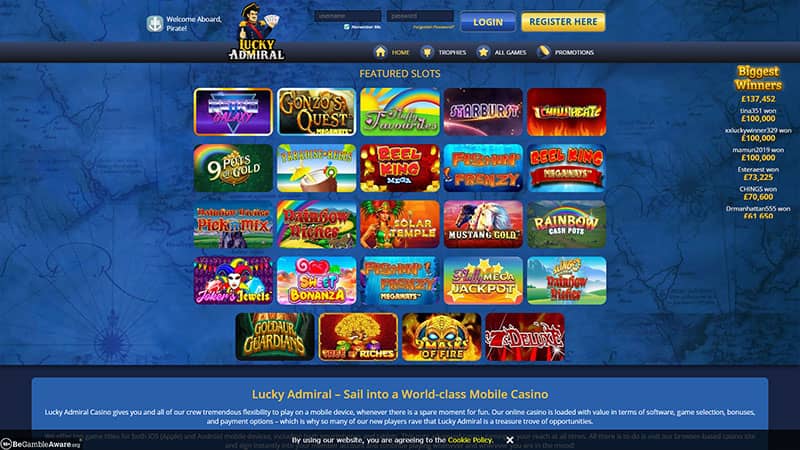

For example, an excellent $ten deposit to the pearl lagoon casino uk restriction multiplier adds $100 inside added bonus finance for you personally, giving you a maximum of $110 to use to the qualified video game. CasinoVibes offer unique added bonus to own Gamblizard that provides an excellent 100% added bonus up to C$three hundred having a substantially lower lowest deposit element C$5. The maximum withdrawal is bound to half a dozen times the initial put amount, and you can people kept fund will be sacrificed. The advantage should be stated in this seven days out of opening an enthusiastic membership. To activate, make sure your current email address is affirmed, following discover incentive out of your character diet plan before you make deposits. The initial deposit should be made within three days, and also the then deposits in this 2 weeks of activation.

- Income you receive within the taxation season which is effectively connected with your trade or company in the united states is, just after deductible deductions, taxed from the rates you to definitely apply to You.S. owners and you can people.

- If you produced efforts in order to a classic IRA to have 2024, you happen to be capable get an IRA deduction.

- If the mate passed away in the 2022 or 2023 and you performed perhaps not remarry through to the end of 2024, you can also be considered so you can document as the a qualifying surviving partner and you will make use of the shared go back income tax rates.

- That it rules applies to folks,along with People, individuals, suppliers and you will Associates.

- Advisable to possess landlords inside Baselane’s property manager banking items.

While you are individually contained in a different country otherwise regions for around 330 full days while in the one chronilogical age of twelve successive weeks, you can even be eligible for the newest overseas earned earnings exemption. At the same time, you are in a position to ban otherwise subtract specific foreign houses quantity. You may also qualify while you are a real resident away from a different nation and you’re a citizen otherwise federal of a nation with which the usa provides a full time income income tax treaty. Resident and nonresident aliens are allowed conditions of revenues in the event the they satisfy particular requirements. An exclusion away from revenues could be money you can get one is not found in their U.S. money and that is maybe not at the mercy of You.S. income tax. That it section discusses a number of the more widespread conditions allowed to resident and nonresident aliens.

We make use of email address to promote for your requirements for the 3rd-group networks for example listings and you can social networking sites. So you can opt from this behavioral advertising, get into your current email address regarding the “Email address” community then discover the “Choose out” key. This type of six inquiries might help decide which account is great to possess you. Pay a $cuatro.95 monthly restoration fee without minimal balance penalty. Earn significantly more on your currency once you create-to the a leading-produce Financial Smartly Bank account to Bank Smartly Checking.

From the FTB

Password 444, Suicide Protection Volunteer Income tax Sum Money – Efforts will be used to fund drama cardiovascular system apps designed to offer suicide avoidance functions. When you’re a great QSF, play with mode FTB 5806, Underpayment away from Estimated Income tax from the Organizations, in order to compute the newest punishment. Inability to statement and you can pay quick can lead to the newest assessment interesting, penalties, and charge. Deduct line 18, money distribution deduction, from the adjusted total income advertised on line 17, and go into the influence. The amount of In the middle of can be’t exceed the fresh taxpayer’s actual miscellaneous itemized deductions.

Country info

List property is private possessions which is inventory as a swap or that is stored mostly available to users in the normal span of the exchange or company. Income in the product sales away from collection which you ordered is acquired the spot where the home is offered. Generally, this is when name for the possessions seats to the customer. For example, money in the sale out of directory in the usa is actually U.S. supply income, if you purchased it in the united states or in a great international country. Unless you file the required statement while the informed me above, you simply can’t claim that you have got a deeper link with an excellent overseas country otherwise places. Hence, the first day of house is the first-day you can be found in the us.

Protection deposits might be refundable otherwise non-refundable, with respect to the terms of the fresh rent. A property manager need show your occupant caused possessions destroy one to exceeds typical wear. At the same time, the newest landlord should provide evidence of the purchase price obtain (otherwise estimated to sustain) to correct the destruction. Immediately after displayed things, constantly in the way of pictures or files, or a look at the brand new rent, clients observe that its circumstances is not worth the problem out of legal step, and they settle. You to definitely veteran property owner quotes you to definitely on the 40 percent away from citizens often difficulty the brand new refund but mentioned that they’s really uncommon those people cases get into courtroom.

For many who closed a lease to the property manager, the fresh property owner accounts for returning your part of the deposit. If you are moving out through to the lease are right up, you may not meet the requirements to get their deposit until the end of the tenancy. To simply help manage your security put, you ought to bring photographs and you may videos of one’s local rental One which just relocate in order to document the position. To get well a hundred% of one’s security places, make sure you get pictures of your after the section (and you may include commentary for the videos of every place).

Your own sum will guarantee you to Alzheimer’s condition receives the desire, research, and you will information it will probably be worth. To find out more, check out cdph.ca.gov and appearance to own Alzheimer. Should your estate otherwise trust finishes form FTB 5805 otherwise form FTB 5805F, mount the proper execution to the back from Form 541. Enter the level of the new penalty on the web 44 and check the proper package.